TRADER'S TRAINING COURSE - JUNIOR ANALYST

WHY THIS TRAINING ?

CHAPTER 1 : BASIC UNDERSTANDING OF SHARE MARKET

CHAPTER 2 (1) : SUNIL PAWAR'S 5 GOLDEN POINTS STRATEGY (5 GPS)

CHAPTER 2 (2)

CHAPTER 2 (3)

CHAPTER 2 (4)

CHAPTER 2 (5)

CHAPTER 3 - SOFTWARE : STOCK TREND PREDICTOR (STP)

COURSE NAME: JUNIOR ANALYST - FREE TRAINING & SOFTWARE by Mr. Sunil S. Pawar - Sebi Registered Research Analyst

For Nifty, Banknifty, Sensex, Stock options software free demo, Message "Software" to Mr. Sunil Pawar on 9890812070

Kindly note, Website visit and self-learning of this training is completely free on this website. It means the learner has to learn training and software by self learning with the help of videos available on this website.

But, if learner wishes to get dedicated trainer and personalized training, and also wishes to complete certification of this course then...

It is also available at Rs.0, but only to our paid clients who purchased our paid package namely "Techno Trader - cash" costing 20,000 as detailed on our website www.optionskingra.com.

Scroll down and Check Sample copy of certificate at the bottom of this page.

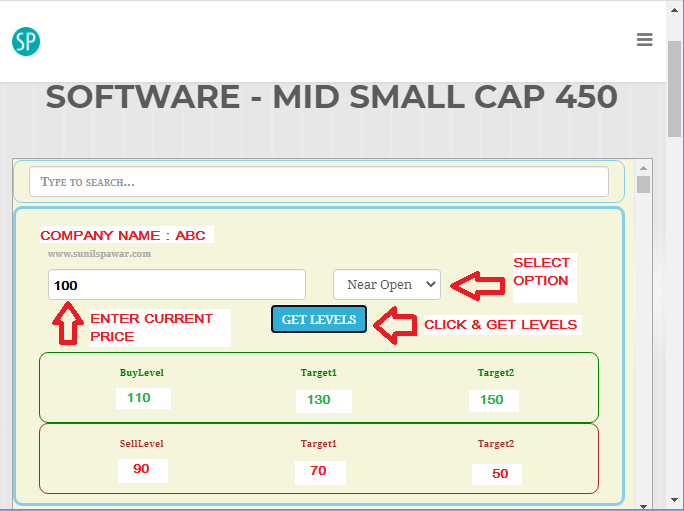

OPENING MESSAGE : PURPOSE BEHIND FREE TRAINING TO INVESTORS. Hello friends welcome, This training course is designed with the purpose of educating common investors and the beginners in Indian stock market. Almost near to 11 cr new demat accounts opened during 2020 to 2024. All these Indian’s have come to stock market in the search of income from stock market. Suddenly all these new investors started searching for all stock market related web content, YouTube channels, Telegram channels etc. This created a big problem in market, these new investors started following all unauthorized and non qualified people on social media who called themselves as market advisors or trainers. Actually these new investors started following all those profiles who talk about stock market and it would take years for these new investors to realize that the knowledge or tips they were getting from their so called market gurus are actually useless. These new investors are actually in danger of falling in trap of scammers, unauthorized and fake market tippers and punters. These new investors just don’t know the basic pros and cons of stock market investments. They just don’t know the difference in fake tipper and a SEBI REGISTERED RESEARCH ANALYST. More than 95 % tippers who give stock tips in social media are not SEBI REGISTERED RESEARCH ANALYST or SEBI REGISTERED INVESTMENT ADVISORS. It means more than 95% of youtubers, Telegram channel holders, face book account holders who collect money from public under the pretext of giving stock market tips or trainings are actually not trust worthy at all. It also means that these 95% fake advisors and trainers are not qualified and not verified by SEBI. Here SEBI means Securities exchange board of India which is a regulatory body for stock market. It regulates stock market just like RBI regulates banks. THIS COURSE CONTECT IS EASY AND SIMPLE TO UNDRSTAND FOR COMMON SHARE MARKET INVESTORS BUT MOST USEFUL IN STOCK MARKET INVESTMENT. Friends, stock market knowledge is a faculty just like any other faculties in engineering, medical etc For example, in engineering, there are many specializations but civil engineer will study only those books which are mandated for civil engineering. It means a civil engineer student will not study books of mechanical, it, production engineering. Same way, in stock market, different knowledge set up is required for Long term investor, short term investor, trader, jobber, arbitrators, stock market analyst, portfolio managers etc. For outsider, all these profiles look same but all of them are completely separate and require different skill and knowledge. For example long term investor must be proficient in fundamental analysis to check valuation of a company stock for long term investment. Whereas short term investor may focus on current positive or negative news in a stock to make profit in short term. In other words an investor who wants to buy a company’s share for 10 years time period will check trends of last 5 to 10 years of balance sheet, profit & loss accounts, products and their demand in market, quality of management etc. But short term investor who wants to buy share for 6 months or 1 year will buy same share just because company made big profit recently. This course is designed for short term investors who wish to buy share for 1 to 3 months for good decent amount of profit with proper understanding of the risk in the investment. BASIC UNDERSTANDING OF STOCK MARKET ACTIVITY: To understand basic functioning of stock market let’s understand how is the flow of activities in stock market. 1) INVESTOR: A person who invests his money in stock market 2) BROKER: A broker is a middleman, it is a company which is authorized to buy and sell shares on behalf of investor. The investor will place order of buying shares with broker and broker will execute the order. After the buy order is executed the investor will receive shares in his demat account. Name of few stock brokers in India i)Angel broking ii)Icici direct iii)Hdfc securities Iv)Upstox v)Zerodha 3) TRADING ACCOUNT – The investor opens trading account with the broker. With trading account investor can buy and sell shares as frequently as he wants. Every trading account has a unique number just like we have unique bank account number. 4) DEMAT ACCOUNT – A demat account or dematerialized account provides the facility of holding shares in dematerialized form. It’s just like bank account where you hold your money and all your entries are registered in your passbook. Same way investor holds his shares in demat account and can check his demat account statement to understand the transaction which he did in his account and he can also check the company wise number of shares in his demat account. Kindly understand difference between Trading account and Dmat account. Trading account is used only for buying and selling shares on the stock exchange. And Dmat account is used for holding shares, bonds etc. Both accounts are required for share market investing. Both accounts are opened at a time. To open both above accounts investor needs to call broker firm and they will open both the accounts for investor. Following documents are required for opening dmat and trading account. Proof of Identity - Driving license, Voter ID etc. Proof of Address – Adhaar card, Ration card etc. Proof of Bank account – Cancelled cheque. PAN – PAN is mandatory for opening Demat account. Photographs – 3 Passport size photos. This much understanding is enough for understanding stock market activities. Kindly note in this training our main focus is to provide only the required knowledge hence we are bypassing all that information which is not necessary at this stage. BASIC UNDERSTANDING OF SHARE MARKET:- What is a share: A share is one part of the equal parts into which company’s capital is divided. What is a company capital : The market value of the cash and all other assets like land,production facilities,offices,buildings,investments like bonds,shares etc. In simple words, Capital of a company is the auction value of all its assets. It is sum total of right from the pen on the table to all the lands, offices, vehicles, buildings, investments and bank balances. In other simple word company capital means the amount in rupees that will be generated by selling all assets of the company. Now, let’s understand what happens when you buy a share of a company…. When a person buys a share in company then the person blocks his % share in that auction value. Now, let’s go back to the definition of share What is a share: A share is one of the equal parts into which company’s capital is divided. We have already seen what company capital is, now we will see what equal part is Every company has particular number of shares in the share market. When a share buyer buys shares of a company then he owns the value which is calculated as total capital divided by number of shares For example, A company’s total of all properties plus assets plus bank balances etc is 100 crore Total number of shares of that company listed in share market = 10000000 (1 crore) So, Value of a share should be 100. Now, First question that may strike your mind is who will decide value of all properties and assets of a company and how to check how many numbers of shares actually available for a company. What is the authenticity of this data and how can we trust it? Friends, this is stock market and it’s directly under surveillance of finance ministry, it is most regulated system. There is independent body namely SEBI who controls all functioning of share market. Every 3 months, listed company has to submit all their profit and loss accounts, Balance sheets to SEBI and to their stock exchanges namely NSE (NATIONAL STOCK EXCHANGE) & BSE (BOMBAY STOCK EXCAHNGE) If there is any smallest information or change in company, It’s immediately reported to NSE and BSE. Most importantly all company wise information like Balance sheets, Profit & loss accounts, Share holding pattern of promoters, and news related to business are immediately updated on websites of NSE and BSE. Here, every investor can see all the critical data and information about the company where he invest and he can take decision of continuing his investment or withdrawing it by selling the shares. Also, NSE and BSE update current market price of the all shares every second so that investor and understand the value of his investment and may take suitable decision. If we invest in land, does anybody tell us its price every second or minute? Now, you can understand share market is most regulated system and there are sufficient bodies available to protect investor interest. Now we will see details of few terms used above:- I)Stock exchange – A place where shares are bought and sold. So, all the orders of shares buyers & shares sellers are executed at NATIONAL STOCK EXCANGE (NSE) and BOMPABY STOCK EXCHANGE ( BSE).You put order of buying or selling of shares with your broker but he further puts orders to NSE or BSE and there your orders are executed. II)SEBI - SECURITIES AND EXCHANGE BOARD OF INDIA is a regulatory body for share market. It’s role in share market is similar to RBI’s role in banking. SEBI is works directly under ministry of finance. If any company is found guilty of breaking SEBI norms and regulations then SEBI has all the powers to debar that company from stock market. Up to now we have understood basic knowledge about share market activities and functioning. Now, let’s move on to the knowledge about how to do buying and selling of shares to make money from share market. SUNIL PAWAR'S "5 GOLDEN POINTS STRATEGY" TO BECOME SUCCESSFUL SHARE MARKET INVESTOR: In share market, buying and selling shares for short term is called as share trading. A person doing it is called as share market Trader or share market investor. In share market, share prices go up or down depending on positive or negative news flow in that particular company or in that sector or in the country as a whole. A successful investor buys a share at lower price and sell the same at higher price. For example, if a investor buys a share at Rs.100 and sells the same share at Rs.150, he is a successful investor because he made Rs.50 profit in this trade. But here the most critical part is How a investor will know when to buy a share so that it goes up from buying price? How a investor will judge that price will go up or down from current price? Next few steps will help you a lot in taking right decisions and in making good profit from your investment. If you want to buy share at Rs.100 and then want to sell at higher price like 130, 150 etc to make profit then you as a investor must check 5 main critical parameters which will decide success of your investment. Let’s check in detail – A investor must invest only in profit making company then only value of his shares will go up and investor may make profit. If he invests in loss making company then share price of a company may go down and investor may face losses in his investment. As we discussed earlier, every company listed on NSE or BSE has to submit their balance sheet and profit & loss account to NSE or BSE on quarterly basis means every 3 month. All the data submitted by the company must be audited and correct; if it is found faulty in SEBI verification then company may face heavy penalties or actions. All this data is freely available in public domain, and investor can check this data at any point of time. A investor can use this data to take right decision over selection of right company shares for investment. This faculty of studying valuations of a particular company is called as Fundamental analysis and thousands of books are written on it. But as I said earlier, in this training our focus is to gain only practical and useful knowledge that will directly be used for share market investing. To check whether company is good or bad for investment we will follow 5 golden parameters 1) MARKET CAPITALIZATION: Market capitalization is commonly called as market cap. Formula to calculate market cap – Market cap = current market price of the share * total number of shares of the company For example, Current price of share as shown on NSE website = 100 Total number of shares of the company as per data on NSE = 10000000 ( 1 crore) Market cap = 100 * 10000000 = 1000000000 (100 crore) There are categories of companies as per their market cap LARGE CAP = COMPANY WITH 20,000 CRORE PLUS MARKET CAP Example – Reliance, Tata motors etc MIDCAP = COMPANY WITH ABOVE 5000 CRORE BUT LESS THAN 20,000 CRORE MARKET CAP Example – Tvsmotors, bankindia etc SMALL CAL = COMPANY WITH LESS THAN 500 CRORE MARKET CAP. Example – Ashokleyland, Suntv etc Why Market Capitalization is so important:- From Market cap we can understand whether company is large cap, midcap, or small cap BIGGER MARKET CAP COMPANIES ARE SAFER FOR INVESTMENT. Companies below 100 crore market cap must be avoided for investment. One important message for investors, do not buy any share just because you recieved message on your mobile, also do not buy any share just because any analyst in media or in social media is telling very big positive news about that share, it may be wrong advice and not good for investment. In past, Many unfair practices were found in low cap companies, hence such companies are not good for investment. 2) P/E RATIO: P/E ratio means price of share v/s earning per share. Formula to calculate PE ratio: CURRENT PRICE OF SHARE / EARNING PER SHARE (EPS) Current price of share is available on NSE and BSE websites and EPS is available on the balance sheet provided by the company and uploaded by NSE or BSE on their websites. For example, Current price of share = 100 EPS shown in latest quarterly balance sheet of the company = 10 Then PE = 100/10 = 10 Even our bank FD has P/E ratio..You can call it Investment to earnings ratio. For example we invested Rs.100000 ( 1 lac ) in bank FD and we got 7000 as interest then Investment earnings ratio = 100000/7000 = 14.28 What is importance of P/E ratio? P/E ratio actually tells us in how many years investment will be double. For example, If company’s share price is 100 and company is generating Rs.10 profit per share then in next 10 years it will generate Rs.100 as profit per share. It means share price may reach Rs.200 in next 10 Years. Same way if bank FD given 7 % return every year then it may take 14 years to double the investment. Here we are calculating simple interest not compounding interest. Now let’s check EPS In detail: EPS is company’s net profit divided by company’s number of shares. What is net profit? For example, a company manufactures and sells Mobile phones If the company sold Rs.100 crore worth mobiles but company had to pay out Rs.80 crore as expenses over raw material, manufacturing, salaries, distributor commission and company makes profit of Rs.20 crore. This profit remained with company after paying all expense Company’s net profit is 20,000,0000 (20 crore) Now, let’s assume company’s total shares are 10000000 (1 Crore) as per NSE or BSE website data. EPS = NET PROFIT / NUMBER OF SHARES Then EPS = 200000000 ( 20 crore ) / 10000000 ( 1 crore) = 20 So, Company got Rs. 20 as earning per share. Now as per laws and SEBI mandate , the company has to pass on this profit to the share holder in the form of dividend or if company wants to use this money for company operations then share holder’s permission is mandatory in Annual general meeting. Now if any investor who bought 100 shares of above company then he will get 20 * 100 = Rs.2000 as dividend on his shares. 3) RISING UPTREND IN NET INCOME (NET PROFIT):- As we discussed every company has to submit balance sheet on quarterly basis to NSE or BSE and investor can check this data on NSE or BSE website any time. Rising trend in net income means if a company is generating higher net income compared to it’s last quarter then that company is good for investment. For example if we check last 4 quarter balance sheet and check figure of net income for each quarter then it would look like this NET INCOME: Quarter ended on September 20 = 10 crore Quarter ended on December 20 = 11 crore Quarter ended on March 21 = 13 crore Quarter ended on June 21 = 15 crore As we can see Net income which is also called as Net profit of the company is rising every quarter. More net income means more EPS means investment will double fast. Such stocks should be selected for investment. Now, let’s see opposite example:- quarter then it would look like this NET INCOME: Quarter ended on September 20 = 10 crore Quarter ended on December 20 = 9 crore Quarter ended on March 21 = 8 crore Quarter ended on June 21 = 6 crore As we can see Net profit or Net Income is falling down every quarter hence this company will not generate good EPS and share price will not go up but may go down. Such share where profit is falling down on quarter on quarter basis must be avoided for investing. 4) ALPHA: Alpha is measure of performance. It measures the excess return the particular stock given relative to the return of Index during that particular period. For example, Period 1 jan 2020 to 31 dec 2020 Company name: ABC Price on 1 jan 2020 : 100 Price on 31 dec 2020 : 150 A investor bought share of ABC on 1 jan 2020 at 100 and sold the same at 150 on 31 dec 2020 Hence company ABC generated Rs.50 profit on Rs.100 invested. Hence, let’s calculate RETURN ON INVESTMENT (ROI) FORMULA OF CALCULATING ROI (SELL PRICE – BUY PRICE ) / BUY PRICE *100 (150-100)/100*100 = 50% Here we calculate return in percent by multiplying with 100 (*100) Index name: SENSEX Price on 1 jan 2020 : 41464 Price on 31 dec 2020 : 47868 ROI = (47868-41464)/41464*100 = 15.44% Now let’s compare PERIOD: 1 JAN 2020 TO 31 JAN 2020 SENSEX ROI = 15.44% ABC ROI = 50% Hence, ABC Company’s share has given more profit than the index SENSEX. Hence, ABC Company’s share is better option for investing. 5) INVESTOR'S INVESTING STRATEGY AND SOFTWARE SETUP : Friends, Without trading strategy and software setup success in share market trading is not possible. Trading strategy covers below points - i)CAPITAL - For investment in share market you need decent amount of capital. This capital investor needs to put in his trading accont so that he can execute the trades.Never increase or decrease capital suddenly.Fix up the amount of your capital and invest same amount of money every time in each trade. For example, if investor has capital of 1,00,000 and if he takes 12 trades in a year then in each trade he should invest 1,00,000 not increasing or decreasing capital suddenly.If investor increase or decrease capital suddenly then his profit and loss will also go up and down abnormally and trading may become difficult. ii) ENTRY, EXIT, AND HOLDING TRADE - When investor decides to buy shares then he shoud make entry in shares when there is highest posibility of share prices going up. Investor must exit from the trade when prices go in adverse direction and stoploss is hit. STOPLOSS is extremely important part of investor's trading strategy. Stoploss is a pre-decided price point where investor will cut his position in shares to avoid further loss of capital. For example - If a investor buys a share at Rs.100 with the understanding that share price will go upto Rs.150. But if share price starts falling down then the investor pre-decides that he would sell the shares if prices come down upto Rs.80. The investor takes this decision to avoid further loss if share price continues falling down. TRAILING STOPLOSS - For example - If a investor buys a share at Rs.100 with the understanding that share price will go upto Rs.150 to 200. It means the investor has kept 2 tragets in his mind as target1 as 150 & target2 as 200. Now let's say share prices reach 150 then investor will still hold the trade of buying position but this time he will put stoploss at buying price of 100. And then let's say share prices reach 200 then investor will still hold the trade of buying position but this time he will put stoploss at price of 150. This way investor will raise his stoploss every time so that he can make maximum profit from rising share prices but every time he is protecting his profit upto last target achieved. NOW MOST IMPORTANT POINT IS - WHEN TO MAKE ENTRY, HOW TO DECIDE WHEN SHARE PRICES WILL GO UP. For a short term investor, it is extremely important to know that what is the current price trend of the particular share. There are many examples in market where share prices of few companies kept falling down even when their financial health was quite good. Also even if a stock is having quite good financial health but if it’s share prices are too volatile meaning there by share prices fluctuate too fast and too high and too down then that share is not good for investing. Also on NSE and BSE there are set upper and lower limits of share prices. It means if the prices of particular share hit upper or lower circuit limit then trading in that particular share suspended for the day. Any such share whose prices hit upper or lower limits frequently is not good for investing. Also a company may have very great financial figures but it’s share may not be generating sufficient ROI on monthly or quarterly basis for investor then that share is not good for investing. To solve all above issues, our company has gone ahead and developed a software for investors namely “ STOCK TREND PREDICTOR (STP) : QUARTERLY CASH POSITIONAL SOFTWARE ” STP IS AVAILABLE FOR FREE TO investors. STP : This is Technical analysis software which helps investors to identify uptrend and down trend possibilities in particular share in the quarters of the year as Jan / Feb / Mar , Apr / May / Jun , Jul / Aug / Sep , Oct / Nov / Dec. Simply Put Closing Price of 1 Jan , Select option " Near Open" and get the levels for JFM quarter. Put Closing Price of 1 Apr , Select option " Near Open" and get the levels for AMJ quarter. Put Closing Price of 1 Jul , Select option " Near Open" and get the levels for JAS quarter. Put Closing Price of 1 Oct , Select option " Near Open" and get the levels for OND quarter. Buy and sell Levels taken on the first trading day of the quarter will remain valid for the whole quarter, Track those levels for those 3 months of that particular quarter. Stoploss of Buy level is sell level STP helps investors check back trades those happened in a particular share in last years so that investor increase his practical knowledge in investing. STP helps investors check month on month ROI generated by investor in particular share. STP guides investors when to invest in a share so that possibilities of profit increase. STP guides investors what should be the buy price for a particular share. STP guides investors what should be the target after buying shares. STP guides investors what stoploss they should keep on their investment. STP is the best friend of investors who guides them towards higher possibilities of profit. YOU WILL BE PROVIDED VIDEO ON STP ON OUR YOUTUBE CHANNEL SO THAT YOU GET COMPLETE VIDEO TUTORIAL ON HOW TO USE STP. So, Click link below and subscribe our you-tube channel for free so that you get STP practical there. https://www.youtube.com/channel/UC8GsYkI-5LSiyLxzgNA4LLQ CHAPTER : 1

CHAPTER : 2(1)

CHAPTER : 2(2)

CHAPTER : 2(3)

CHAPTER : 2(4)

CHAPTER : 2(5)

CHAPTER : 3

SAMPLE COPY OF CERTIFICATE :-

Special note and desclaimer - Holder of this certificate is not entitled to give and buy,sell,hold recommonadtions in stock market. Any mis-represenatation of this certificate is strictly prohibited.

Junior Analyst is only the name of course and not any entitlement or registration to pass any training or recommondations over stocks,indices or over all stock market.

The course name is kept Junior Analyst with the intention that every person should look at stocks and stock market from an analyst perspective and not from perspective of speculator or gambler. As today's biggest problem is, crores of traders come to stock market every year but they do not focus on analysing and investing for long term investment but majority of them focus on speculation and gambling type of trading which has higher chances of resulting in losses.